If you are running Adsense in your website, you are in a way providing a service to your advertiser. And by definition of Indian laws, service tax needs to be charged for every advertisement displayed on your site. Online advertising was except from this tax earlier, but effective Oct 1st 2014, the exception is removed and service tax is applicable.

This leaves a lot of confusion for every Indian blog or website owner who use Adsense for monetization. Do we need to pay service tax? Ho should we calculate it? Should we register for service tax ... well the good news is that nothing needs to be done.

Who needs to pay service tax?

If an advertiser is using your ad space and paying you directly for it, you are responsible for collecting service tax from the advertiser. But with Adsense, the service provider is Adsense and all the INDIAN advertisers whose ads show up on your site are the customers. That means from 1st October 2014, Adsense needs to collect 12.36% extra from all INDIAN advertisers.

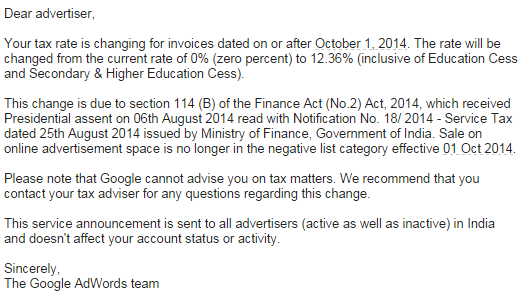

In fact Google has already started sending emails to Indian AdWords users about the extra 12.36% tax implication. Here's one -

Is the new service tax good or bad for me?

As a blog owner, you will definitely be relieved. But think about it- are you winning? If a big chunk of your site traffic is from outside India, then yes you are immune to the new service tax. But if you depend more on Indian advertisers, chances are your Adsense revenue will show a dip starting Oct 1.

Just because there is a new service tax doesn't mean all advertisers are going to raise their ad budgets. They would bid the same as they used to earlier, but Adsense would be counting 12.36% of each click revenue as service tax.

Should ads on my site be exempt if income is less than ₹10L?

By law, you need to collect and pay service tax only if your annual income exceeds ₹10Lakh. Small publishers could argue that website owners are the service providers since they provide the ad space as a service and Adsense is only the intermediary. If the responsibility to collect and remit service tax is with the site owners, any body who makes less than ₹10L could simply do away with service tax for all the ads on their site. In fact, Adsense could show higher value ads in smaller sites because they would be exempt from service tax :)

But the Income Tax department goes with the slogan -

Take everything you can, give nothing back.

It is much easier and more profitable to deal with and tax one big Adsense directly rather than a thousand small publishers :)